Dovish

Dovish is a decentralized strategy vault management protocol that deploys high returns risk-managed vaults.

We update our oracles with our signals generated with our state of the art quant models that have been robustly tested against the crypto markets.

This ensures our vaults can be rebalanced in the most optimal way by anyone to maximize yield and minimize risk.

Our smart contract code is a fork of Set Protocol, which has powered many other major crypto protocols, notably Index Coop.

- For our vault holders: Performance statistics and Fees

- For protocols looking to integrate our products: Smart Contract Documentation

Performance statistics

Dovish will provide multiple strategies with different risk categories and liquidity capacities. Simply buying the strategy tokens will enable you to capture the alpha of our models!

Strategies released:

ETH Stability Vault

Token address (Polygon): 0x9D22Db5BBce79a5dAe3200D2B7D46E2f86e3B546

You can purchase any amounts of these tokens from our marketplace. Learn how to purchase our strategies, and see their tokens on your wallet here!

Statistics on the average ETH Hodler’s performance:

Average APY over the past 3 years: 135%

Change in value over the past 3 years: ~1300%

Sharpe Ratio: 1.2

Statistics on vault performance:

ETH Stability Vault:

Average APY over the past 3 years: 236%

Change in value over the past 3 years: ~3899%

Sharpe Ratio: 1.9

Strategy max capacities:

ETH Stability Vault (Launch phase): 5M USD Capacity

As time passes, we will work on increasing the maximum capacity of our vaults. Our models are capable of managing more, but we want to first ensure a seamless investment experience for our users!

How to buy/sell Dovish Strategy Tokens

Simply navigate to our marketplace tab, click on learn more, and key in the amount you wish to purchase in USDC!

After you approve of the purchase, you should see the transaction pop up like this.

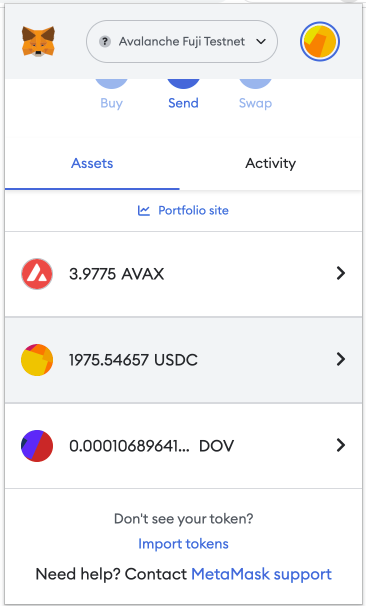

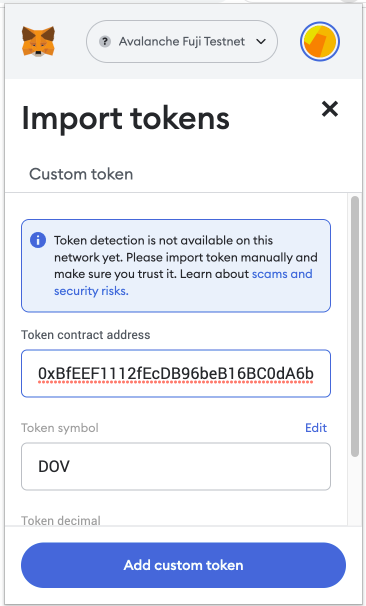

After the transaction is complete, you need to add our token address to your metamask wallet to be able to see your strategy tokens!

Get the relevant token address to input by referring to the token address that you see on the pop up modal that you bought your strategy from!

Alternatively, you can also refer to our Performance statistics page to get the token address of the strategy you wish to buy!

Fees

Dovish believes that the DeFi space should be strictly win-win.

And we believe the best way to signal that belief of ours to our users is through our fee structure:

Fee Structure

- 1% streaming fee per annum, collected throughout the year.

- 0.5% redemption fee.

- 0% issuance fee.

Why are the fees structured as such?

The underlying reason for this setup is that the Dovish protocol is incentivized to perform well enough that users are happy to leave their money in our automated strategies.

Furthermore, users are not punished for slowly DCA-ing into their crypto investments into Dovish, and can take their time to grow their crypto wealth.

The redemption fee is also to deter any attacks on the protocol from front-running the Dovish protocol when oracle prices are volatile.

Roadmap

1st Quarter 2023:

- Launch on mainnet

- Release user portfolio analysis tool

2nd Quarter 2023:

- Extend analysis tools to include more advanced holdings like LP tokens etc

- Launch tool for users to run Monte Carlo simulations on different vaults

2nd Quarter 2023:

- New vaults to address different market risks, e.g. ETH gas futures, index options

Contracts

Polygon:

- Controller contract: 0xC4aF5629b743b9ff33f42845F8150a70Bf7Be2B8

- Basic issuance contract: 0x5F9fb0d163B94CDcE480cF52A7317Ba10B601700

- Integration registry contract: 0x18e61Ab58b7a529b5c9C0E914470f6e298Ff9CD1

- Set token creator contract: 0x8B7c868987e1Fac0f0E683cC3Aa5Fa936844efe3

- Price Oracle: 0xcf5Fa1bE4339F98d0d887f811416B6919038DeDc

- Set valuer contract: 0x06A3Ff34E0A754D93341DA48a81d481A19Ba754d

- Streaming fee module contract: 0x768FD63c1449CC6DceC67ad8EE59807BE74eC2c3

- CustomOracleNavIssuanceModuleInterface contract: 0xfff5aB9b3e6ACA526C826D711ea67eb2E12fec2A

- wethIndexModuleInterface contract: 0xA64dD98483015256024A72F3135EdEef6a39c83c

- uniswapV3ExchangeAdapterV2Interface contract: 0x91726FDfbE4E468435175C914F4177556FF54184

Audit

Dovish’s contracts are a fork off Set Protocol’s.

However, we have made 2 vital changes to our protocol.

- We have changed it to be compatible with Wrapped ETH, not just ETH.

- Our protocol will still be in charge of outlining the parameters for rebalancing, but any user can call the trade function to rebalance the vault. This decentralization means that our users can be confident that the rebalancing will be done in a fair and transparent manner.

You can refer to wethIndexModule.sol to have a closer look at the main modification made to take this into account. wethIndexModule is a modified version of Set's SingleIndexModule.sol Aside from that, Dovish’s contracts makes some basic changes to Set Protocol to be usable with Solidity 0.8.

The original contracts have been audited by OpenZeppelin and ABDK consulting. You can find the reports from those audits below.

Our edited contracts have been audited by audited by Solidity Finance, a leading smart contract auditor with over 1500+ contracts audited. A link to our audit report can be found here.

Community Groups

Check us out at these platforms to hear about our latest developments and to get involved in the community:

Twitter: https://twitter.com/DovishFi

FAQ

Bad time to launch? (Post FTX crash and whatnot)

- Pretty much, but we believe our vaults are valuable regardless of market conditions. Our models are designed to be resilient to market conditions and our vault performance reflects that.

- Also, we don't have the ability to lock up anyone's funds. Anyone can pull their money out at any time. And that's where the brilliance of DeFi truly lies in. Being able to program your own vaults to be 100% trustless.

Why should I trust you?

- Crypto is a tough space to get trust in. And we understand that. We don't think providing more numbers on APY and a bunch of new complicated tokens will help.

- Instead, the Dovish team is here to provide a transparent vault management service. If you hop on over to our indicator page, you will see our signals throughout the past year.

- Compare that to the price of ETH and you will realize that we catch most of the upswings/downswings in the market. We are not perfect, but we believe our track record speaks for itself.